REVENUE CYCLE

Practice Resources

MedCom appreciates the fantastic results our Chiropractors achieve with their patients. We want to make sure their businesses thrive so they can continue to deliver outstanding services and products to people in need.

Contained in this section of the website is a collection of resources our clients have found to be invaluable for managing their practice.

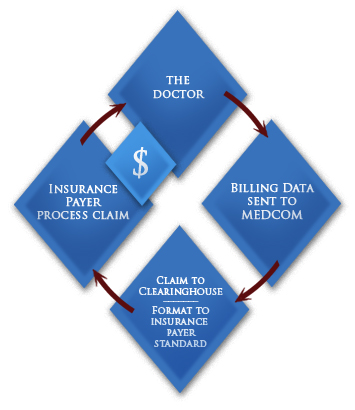

A universal truth in any medical field is that billing and claims add a thick layer of complexity to the management of an efficient profitable practice. We are all too familiar with the pain, headaches, high costs, and poor cash flow that manifest from this complexity. However, most of us are not aware of the actual source of these symptoms. A richer understanding of billing will help you better manage your practice with fewer aches and pains. The image below is a gateway into a deeper understanding of the claims process.

From Claims to Cash: How Your Bills are Processed

Once billing and/or claim data is received from the doctor, the billing service thoroughly reviews the information for accuracy and compliance with insurance payer standards. However, the data is still not ready to be sent to the insurance company.

It must first be correctly formatted to meet the specifications of the insurance company’s proprietary systems. A clearinghouse further formats the data so it can be "read" and received by the specific insurance payer’s systems. As long as the data is received with no errors and in the correct format, the insurance payer then processes the claim.

The funds are sent directly to the doctor. A reputable billing service will not expect to be paid until the doctor has received their money from the insurance company.

Trying to "short cut" this process by skipping steps ironically ends up extending the processing time and holding up receipt of funds. Instead of fighting the process, it is much better to understand it and work within the established structure.

National statistics show only 70 percent of insurance claims, initially submitted on paper, are ever paid by insurance carriers. With electronic submission MedCom can increase the percentage of claims paid to around 98 percent. Statistics show turnaround on paper claims to be 30, 60, even 90 days or longer, creating serious outstanding receivables for the practice. By submitting claims electronically, MedCom can generally have money in the physicians's hand within 14-18 days. Therefore this reduces outstanding receivables proportionately and tremendously improves cash flow.